Managed File Transfer (MFT) for Financial Services: Software Buyer’s Guide

In the fast–paced, data–intensive financial services industry, the significance of Managed File Transfer (MFT) software cannot be overstated. With escalating demands for data privacy, regulatory compliance, and operational efficiency, managed file transfer solutions have become indispensable. These platforms ensure secure, efficient, and reliable transfer of sensitive financial and customer data between systems, offices, and partners.

This guide is designed to assist IT professionals in the financial services sector in navigating the crowded MFT solution landscape, educating and empowering buyers so they can make an informed decision that aligns with their financial institution’s needs in 2024.

Still debating between FTP and managed file transfer? Here are six reasons why managed file transfer is better than FTP.

Managed File Transfer (MFT) Software Overview

Managed File Transfer (MFT) software provides organizations in every industry a critical solution in today’s highly digital and data–driven business environments. At its core, managed file transfer solutions are designed to securely manage, transfer, and monitor files and data across various networks and systems. Unlike standard file transfer protocol (FTP), managed file transfer offers enhanced security, reliability, and tracking, making it a superior choice for organizations that prioritize data protection and compliance. This technology ensures that financial institutions can share sensitive information, such as customer account data, contracts, and financial reports, both internally and with trusted external partners, without compromising security or efficiency.

MFT solutions also come equipped with features that automate and streamline the process of transferring these files. Automation not only reduces the risk of human error but also significantly enhances operational efficiency, allowing financial services organizations to focus more on their core activities and less on the technical details of data transfer. With the advent of cloud–based MFT solutions, these benefits have been further amplified, offering scalability and flexibility to meet the evolving demands of financial services institutions.

Why Managed File Transfer is Crucial for the Financial Services Industry

Cyber threats that lead to data breaches and compliance violations are becoming increasingly common. Given the sensitivity of the information financial services institutions process, transfer, and store, these organizations are prime targets for cybercriminals. As a result, managed file transfer software solutions should be viewed as much more than just a tool for facilitating smoother operations. Instead, they are a critical component in a financial institution’s cybersecurity framework.

The secure transfer protocols offered by MFT solutions ensure that sensitive content, whether at rest or in transit, remains inaccessible to unauthorized parties. This level of security is paramount for maintaining customer trust and adhering to regulations such as the Payment Card Industry Data Security Standard (PCI DSS), General Data Protection Regulation (GDPR), the Sarbanes–Oxley Act (SOX) and many other state, national, and industry data privacy regulations.

Financial services organizations process mountains of data and much of it must be exchanged with trusted third parties like customers, partners, consultants, auditors, regulators, and others. MFT solutions offer organizations a method to manage this data efficiently while minimizing risks that can lead to unauthorized access. The ability to automate file transfers, track the movement of sensitive information with detailed logs, and generate reports for audit purposes are critical requirements for financial services organizations. By aligning a managed file transfer software solution with compliance mandates and providing robust data protection, financial institutions safeguard their reputations and avoid the financial penalties associated with data breaches.

KEY TAKEAWAYS

KEY TAKEAWAYS

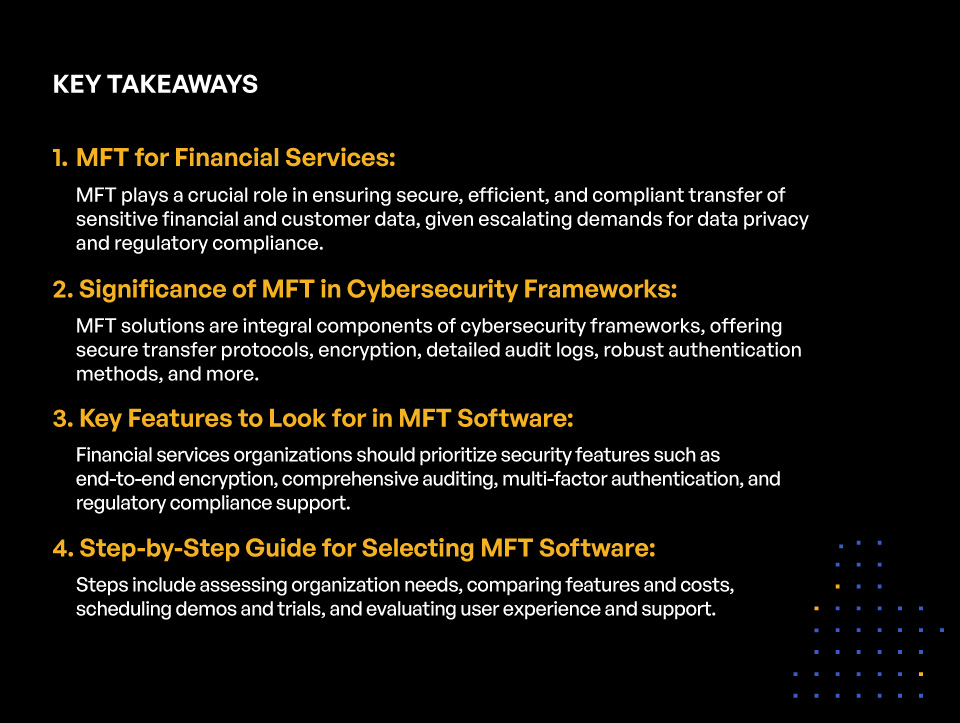

- MFT for Financial Services:

MFT plays a crucial role in ensuring secure, efficient, and compliant transfer of sensitive financial and customer data, given escalating demands for data privacy and regulatory compliance. - Significance of MFT in Cybersecurity Frameworks:

MFT solutions are integral components of cybersecurity frameworks, offering secure transfer protocols, encryption, detailed audit logs, robust authentication methods, and more. - Key Features to Look for in MFT Software:

Financial services organizations should prioritize security features such as end-to-end encryption, comprehensive auditing, multi-factor authentication, and regulatory compliance support. - Step-by-Step Guide for Selecting MFT Software:

Steps include assessing organization needs, comparing features and costs, scheduling demos and trials, and evaluating user experience and support.

Key Features to Look for in Managed File Transfer Software

When selecting a managed file transfer software solution, it is crucial for financial services organizations to consider features that align with their unique business needs.

Security should top the list. Let’s take a closer look at some critical security features every MFT software solution should have.

- End–to–end encryption: This encryption method ensures that data is encoded at its source and only decrypted at its intended destination. Employing end-to-end encryption means that files remain secure throughout the entire transfer process.

- Secure file transfer protocols FTPS, SFTP, HTTPS, and other secure file transfer protocols provide encrypted channels for data transmission, facilitating the safe exchange of financial data. This includes client information, transaction records, and other sensitive content that requires stringent compliance with financial regulations and data protection laws.

- Comprehensive auditing: Financial institutions need to track file movement meticulously to comply with regulatory requirements. Detailed audit logs and reporting functionalities enable financial services organizations to monitor, record, and verify every file transfer activity.

- Robust authentication methods: Verifying a user’s identity is crucial for managed file transfers because it ensures that only authorized users can send or receive sensitive financial information, mitigating the risk of unauthorized access. Authentication can include passwords, security tokens, or biometric verification.

- Regulatory compliance: GLBA, GDPR, CCPA, PCI–DSS and other regulations mandate the secure handling of sensitive information, making compliance an essential feature of any MFT solution. An MFT software solution that supports regulatory compliance protects sensitive content through encrypted transfers, audit trails, automated reporting, and advanced authentication methods.

- Automation: Advanced automation capabilities enhance security by significantly reducing the potential for human error. By automating manual processes, MFT software solutions eliminate the need for continuous manual oversight; the lower the level of human intervention, the lower the risk of data breaches and compliance violations.

This list is only a subset of security features that modern managed file transfer software solutions provide. Nevertheless, the features listed above should be considered essential.

Selecting the Best MFT Software for Your Financial Services Organization: A Step–by–Step Guide

Selecting the right managed file transfer software is crucial for maintaining the integrity and confidentiality of sensitive financial data. With a multitude of options on the market, finding the best MFT solution for your organization can seem daunting. The step–by–step guide we provide below is designed to simplify the process, focusing on key features, compliance standards, and integration capabilities that are essential for financial services organizations. By understanding the specific needs of the financial sector and how different MFT solutions can meet these requirements, you can make an informed decision that safeguards your data while enhancing operational efficiency.

Assess Your Financial Institution’s Needs

Before you select the MFT software solution for your financial institution, it is essential to conduct a thorough assessment of your organization’s specific needs. Consider factors such as the volume of data you handle, the complexity of your data workflows, and the regulatory environments in which you operate. Understanding these requirements will help you identify the features that are non–negotiable in your MFT solution.

Additionally, it’s crucial to involve stakeholders from various departments, such as IT, compliance, and operations, to ensure that the selected MFT software meets the broad needs of your organization.

Furthermore, assess your current data transfer processes and identify any gaps or pain points that an MFT solution could address. This might include inefficiencies in manual processes, difficulties in tracking file transfers for audit purposes, or challenges in managing data securely when sharing with external partners. A comprehensive needs assessment will provide a solid foundation for your MFT software selection process.

Compare Top MFT Software Solutions and Features

Once you’ve defined your requirements, the next step is to compare the features of various MFT solutions. Look for software that offers robust security measures, including end–to–end encryption and support for advanced security protocols. Compare how different solutions handle large volumes of data and evaluate their scalability. Automated workflow capabilities, ease of integration with existing systems, and compliance support are other essential features to compare.

Naturally, cost will be a major consideration in choosing a managed file transfer software solution. The cost of MFT software can vary significantly based on the features, scalability, and level of support offered. Examine the pricing and subscription plans carefully, considering both current and future needs. Some vendors offer flexible pricing models that can adapt to your institution’s growth and changing requirements, which can provide long–term value.

Conducting a cost–benefit analysis is crucial in choosing an MFT solution that offers the best value for your investment. Consider not only the upfront costs or subscription fees but also the potential savings from increased efficiency, reduced risk of data breaches, and avoidance of non–compliance penalties. Additionally, factor in the costs associated with implementing the solution, including any necessary training and system modifications.

Schedule Demos and Free Trial Test Drives

Before making a final decision, take advantage of demos and free trials offered by MFT software vendors. This allows you to test the software in your environment and evaluate its ease of use, compatibility with your existing systems, and whether it meets your operational needs. During the trial period, pay particular attention to the software’s performance, its user interface, and the quality of customer support provided by the vendor.

Evaluating User Experience and Support

The user experience and level of support offered are critical factors in the success of any software implementation. Evaluate the responsiveness of the vendor’s support team and the availability of resources such as training materials and user communities. A solution that is intuitive and supported by an active and helpful community can significantly enhance user adoption and satisfaction.

Implementing Your Chosen MFT Solution

Successful implementation of MFT software requires careful planning and adherence to best practices. Establish a clear implementation roadmap, engage stakeholders from across the organization, and ensure thorough testing before going live. It’s also advisable to start with a pilot phase, allowing you to address any issues before rolling out the solution more broadly.

Training and User Adoption

Comprehensive training programs are essential to ensure that your team can effectively use the new MFT solution. Offer training sessions tailored to different user roles and consider ongoing support and refresher courses to help users keep up with any software updates or changes. Fostering user adoption from the outset can significantly enhance the value your organization derives from the MFT solution.

Ongoing Management and Support

After the initial implementation, ongoing management and support are critical to maintain the security, efficiency, and compliance of your MFT solution. Establish procedures for regular software updates, monitoring, and audits to ensure the system continues to meet your needs effectively. Additionally, maintain a good relationship with your vendor for continuous support and to stay informed about new features or enhancements that could benefit your institution.

Kiteworks Helps Financial Institutions Protect Their Sensitive Content With Secure Managed File Transfer

Selecting and implementing the right MFT software solution is a pivotal decision for financial institutions. By carefully assessing your needs, comparing top solutions, and following best practices for implementation and ongoing management, your institution can significantly enhance its data transfer processes. Finally, a well–chosen MFT solution will not only ensure the security and compliance of your data transfers but also improve operational efficiency and support your institution’s growth and success.

The Kiteworks Private Content Network, a FIPS 140-2 Level validated secure file sharing and file transfer platform, consolidates email, file sharing, web forms, SFTP and managed file transfer, so organizations control, protect, and track every file as it enters and exits the organization.

Kiteworks secure managed file transfer provides robust automation, reliable, scalable operations management, and simple, code-free forms and visual editing. It is designed with a focus on security, visibility, and compliance. In fact, Kiteworks handles all the logging, governance, and security requirements with centralized policy administration while a hardened virtual appliance protects data and metadata from malicious insiders and advanced persistent threats. As a result, businesses can transfer files securely while maintaining compliance with relevant regulations.

Kiteworks secure managed file transfer supports flexible flows to transfer files between various types of data sources and destinations over a variety of protocols. In addition, the solution provides an array of authoring and management functions, including an Operations Web Console, drag-and-drop flow authoring, declarative custom operators, and the ability to run on schedule, event, file detection, or manually.

Finally, the Kiteworks Secure Managed File Transfer Client provides access to commonly-used repositories such as Kiteworks folders, SFTP Servers, FTPS, CIFS File Shares, OneDrive for Business, SharePoint Online, Box, Dropbox, and others.

In total, Kiteworks secure managed file transfer provides complete visibility, compliance, and control over IP, PII, PHI, and other sensitive content, utilizing state–of–the–art encryption, built-in audit trails, compliance reporting, and role-based policies.

To learn more about Kiteworks Secure Managed File Transfer and its security, compliance, and automation capabilities, schedule a custom demo today.

Additional Resources

- Blog Post 6 Reasons Why Managed File Transfer is Better than FTP

- Blog Post Secure Managed File Transfer: Which Solution is Best for Your Business?

- Video Kiteworks Secure Managed File Transfer: The Most Secure and Advanced Managed File Transfer Solution

- Blog Post Navigate Complex Financial Regulations With Secure Managed File Transfer

- Blog Post Eleven Requirements for Secure Managed File Transfer