Data Sovereignty for Financial Services Companies

Data sovereignty refers to the concept of having control over the data generated by individuals or organizations within a specific geographical location. In the context of financial services companies, data sovereignty becomes crucial as they handle sensitive financial information of their customers. Understanding the concept of data sovereignty is essential for these companies to ensure compliance with regulations and protect the privacy and security of their clients’ data.

What Data Compliance Standards Matter?

Understanding Data Sovereignty

Data sovereignty can be defined as the legal right of an organization to retain ownership and control over the data it generates or processes within its jurisdiction. This means that financial services companies have the authority to determine how the data is collected, stored, and accessed, in accordance with the applicable laws and regulations.

When it comes to data sovereignty, it is important to understand that it goes beyond simply having physical control over the data. It encompasses the ability to make decisions regarding data management, including where it is stored, who has access to it, and how it is protected. This control is crucial in ensuring the security and privacy of sensitive information.

Importance of Data Sovereignty in Today’s Business Environment

In today’s competitive business environment, data has become a valuable asset for businesses, especially financial services companies. They rely heavily on the collection and analysis of vast amounts of data to provide personalized and efficient services to their customers. However, with this reliance comes the responsibility to ensure the security, privacy, and compliance of the data.

Data sovereignty plays a crucial role in fulfilling these responsibilities. By having control over the data they process and store, financial services companies can ensure that it is protected from unauthorized access, breaches, and misuse. Moreover, data sovereignty also helps in addressing legal and regulatory requirements regarding data protection and privacy.

One of the key benefits of data sovereignty is the ability to tailor data management practices to specific jurisdictions. Different countries have different laws and regulations regarding data protection and privacy. By retaining ownership and control over their data, financial services companies can ensure that they comply with the specific requirements of each jurisdiction they operate in.

Furthermore, data sovereignty also enables organizations to respond to legal requests and regulatory inquiries more effectively.

When data is stored within the organization’s jurisdiction, it becomes easier to access and provide the necessary information in a timely manner. This can help in avoiding legal complications and ensuring smooth operations.

Another aspect to consider is the potential impact of data breaches. In the event of a data breach, having data sovereignty can provide financial services companies with more control over the situation. They can take immediate action to mitigate the damage, notify affected individuals or authorities, and implement necessary measures to prevent future breaches. This level of control is crucial in maintaining trust and credibility with customers and stakeholders.

Moreover, data sovereignty also plays a role in fostering innovation and competitiveness. By having control over their data, financial services companies can leverage it to develop new products and services, improve customer experiences, and gain a competitive edge in the market. This ability to harness the power of data is essential in today’s rapidly evolving digital landscape.

In conclusion, data sovereignty is a critical concept in today’s digital world, particularly for financial services companies. It grants them the legal right to retain ownership and control over their data, ensuring its security, privacy, and compliance with applicable laws and regulations. By understanding and implementing data sovereignty practices, organizations can safeguard their data, respond effectively to legal and regulatory requirements, and drive innovation and competitiveness.

The Role of Data Sovereignty in Financial Services

Data sovereignty is a critical aspect of managing financial data in the modern era. Financial services companies handle vast amounts of sensitive information, including customer transactions, account details, and personal data. Safeguarding this data is not only essential for maintaining customer trust but also for complying with data protection regulations.

Managing Financial Data

Financial services companies deal with vast amounts of financial data, including customer transactions, account information, and sensitive personal details. Managing this data securely is of utmost importance to maintain customer trust and comply with data protection regulations.

Implementing robust data management practices is crucial for financial services companies, and data sovereignty plays a significant role in achieving this. By exercising data sovereignty, these companies can choose where and how to store their data. They can implement encryption and access controls to ensure that only authorized personnel can access the information. Additionally, strict security measures can be put in place to prevent unauthorized access or breaches.

Furthermore, data sovereignty allows financial services companies to have complete control over their data. This control enables them to determine the best strategies for data storage and management, taking into account factors such as security, efficiency, and compliance.

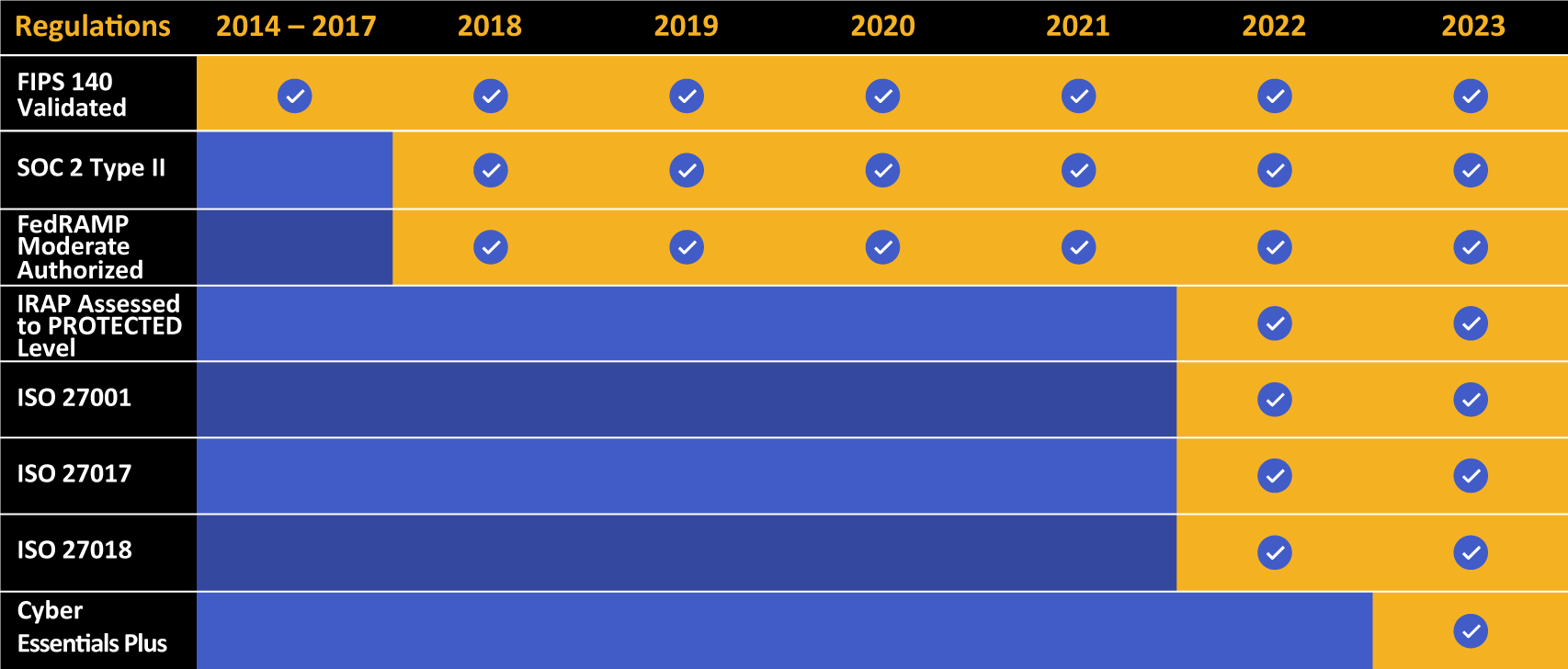

Kiteworks touts a long list of compliance and certification achievements.

Compliance and Regulatory Requirements

Financial services companies are subject to numerous regulations and compliance requirements, aimed at safeguarding customer data, preventing money laundering, and ensuring fair practices. Data sovereignty plays a vital role in meeting these requirements.

One of the significant benefits of data sovereignty is its ability to help companies comply with regional data protection and privacy laws. By exercising data sovereignty, financial services companies can ensure that customer data is not stored or processed in jurisdictions where the laws might be less stringent. This reduces the risk of non-compliance and potential legal issues.

Moreover, having control over their data allows financial institutions to respond effectively to regulatory audits and investigations. When regulatory authorities request access to data or conduct audits, companies with data sovereignty can easily provide the necessary information and demonstrate compliance with regulatory requirements.

Overall, data sovereignty is a crucial aspect of managing financial data in the financial services industry. It empowers companies to implement robust data management practices, comply with regulatory requirements, and maintain customer trust. By exercising data sovereignty, financial services companies can ensure the security, privacy, and integrity of their data, ultimately contributing to a more secure and trustworthy financial ecosystem.

Challenges in Implementing Data Sovereignty

Data sovereignty, the concept of ensuring that data is stored and processed within the jurisdiction it originates, is a crucial consideration for financial services companies. However, implementing data sovereignty measures is not without its challenges. These challenges can be categorized into technological, legal, and regulatory aspects.

Technological Challenges

One major challenge in implementing data sovereignty is ensuring data availability and accessibility. Financial institutions generate vast amounts of data on a daily basis, and it is essential to have systems and infrastructure that can handle the storage and processing demands of this data. Investing in robust data storage solutions, implementing scalable architectures, and establishing redundancy mechanisms are critical to ensuring data is always available and accessible.

Furthermore, financial services companies must also consider the security of their data. Protecting sensitive financial information from unauthorized access or breaches is of paramount importance. Implementing robust security measures, such as encryption and access controls, is necessary to safeguard data sovereignty.

Legal and Regulatory Challenges

The legal and regulatory landscape surrounding data sovereignty can be complex and dynamic, posing additional challenges for financial services companies.

One significant challenge lies in navigating the different data protection and privacy laws across various jurisdictions. Financial institutions operating in multiple countries must comply with the requirements of each jurisdiction, which may involve understanding the nuanced differences in data protection laws. This can be a time-consuming and resource-intensive process, requiring legal expertise to ensure compliance.

Moreover, data sovereignty can also be subject to changes in regulations. Governments may introduce new laws or amend existing ones, requiring financial services companies to adapt their data sovereignty strategies accordingly. Staying up-to-date with evolving regulations and ensuring compliance can be an ongoing challenge for organizations.

Additionally, data sovereignty can also impact cross-border data transfers. Financial institutions that operate globally may need to establish secure file transfer mechanisms that comply with the regulations of different jurisdictions. This can involve implementing data transfer agreements, such as Standard Contractual Clauses or Binding Corporate Rules, to ensure the lawful transfer of data across borders.

Ultimately, implementing data sovereignty in financial services companies requires addressing various technological, legal, and regulatory challenges. From ensuring data availability and accessibility to navigating complex legal landscapes, organizations must invest time, resources, and expertise to establish effective data sovereignty measures.

Best Practices for Achieving Data Sovereignty in Financial Services

To achieve data sovereignty, financial services companies need to adopt data management best practices.

This includes conducting a comprehensive data inventory to identify the types of data they collect and process, as well as the associated risks. Additionally, implementing data classification policies can help ensure that appropriate security measures are applied based on the sensitivity of the data.

Companies should also establish data governance frameworks that clearly define roles and responsibilities regarding data management. This includes assigning ownership and accountability for data protection, privacy, and access control.

Leveraging Technology for Data Sovereignty

Technological advancements can play a significant role in achieving data sovereignty in financial services companies.

Implementing robust data encryption measures can help protect the confidentiality and integrity of data. Encryption ensures that even if unauthorized access occurs, the data remains unreadable.

Moreover, leveraging cloud computing and data storage solutions that offer data residency options can enable financial services companies to have control over where their data is stored. This ensures compliance with data sovereignty requirements while leveraging the scalability and flexibility of cloud technologies.

The Future of Data Sovereignty in Financial Services

The field of data sovereignty is continuously evolving, and several emerging trends can shape its future in the financial services industry.

One such trend is the increasing focus on cross-border data transfer regulations. Many countries are enacting laws that impose restrictions on the transfer of personal data outside their borders. Financial services companies need to closely monitor these developments and adopt strategies to meet the requirements, such as implementing data localization measures or obtaining necessary approvals for data transfers.

Predictions and Expectations for the Future

The future of data sovereignty in financial services holds several expectations and predictions.

Firstly, there will be an increased emphasis on privacy and data protection laws. As individuals become more aware of data privacy issues, regulators are likely to introduce stricter regulations, forcing financial services companies to strengthen their data sovereignty practices to maintain compliance.

Secondly, advancements in data analytics and artificial intelligence may present new challenges and opportunities for data sovereignty. Financial institutions will need to strike a balance between leveraging these technologies for personalized services while ensuring the security and privacy of the data being analyzed.

Kiteworks Helps Financial Services Companies Comply with Data Sovereignty Requirements

Data sovereignty is of utmost importance for financial services companies. It allows them to maintain control over their data, comply with regulations, and protect the privacy and security of their customers’ information. By implementing data management best practices and leveraging technology, these companies can ensure data sovereignty while adapting to the evolving legal and technological landscape.

The Kiteworks Private Content Network, a FIPS 140-2 Level 1 validated secure file sharing and file transfer platform, consolidates email, file sharing, web forms, SFTP and managed file transfer, so organizations control, protect, and track every file as it enters and exits the organization.

Kiteworks plays a crucial role in financial services companies’ data sovereignty efforts. For example, Kiteworks’ encryption and access control features protect personal information during cross-border transfers, ensuring secure transmission.

Kiteworks’ extensive deployment options, including private, hybrid, and FedRAMP virtual private cloud, can be configured to store data in specific geographic locations. By storing data in specific locations, organizations can ensure that they are adhering to the data sovereignty laws of the countries in which they operate.

Kiteworks also supports data portability requirements by enabling users to securely access, transfer, and download their personal information. Kiteworks also provides organizations with the ability to establish opt-in mechanisms and procedures for data collection, detailed consent forms, and minor consent procedures. These features help organizations comply with consent requirements, which are a key aspect of data sovereignty.

Finally, Kiteworks’ detailed audit trail enables organizations to prove their compliance with data sovereignty laws to auditors.

With Kiteworks: control access to sensitive content; protect it when it’s shared externally using automated end-to-end encryption, multi-factor authentication, and security infrastructure integrations; see, track, and report all file activity, namely who sends what to whom, when, and how.

Finally demonstrate compliance with regulations and standards like GDPR, HIPAA, CMMC, Cyber Essentials Plus, IRAP, and many more.

To learn more about Kiteworks, schedule a custom demo today.

Additional Resources

- Brief Expand Visibility and Automate Protection of All Sensitive Email

- Brief Navigate the Digital Trifecta of Data Sovereignty, Cybersecurity, and Compliance With Kiteworks

- Blog Post Data Sovereignty and GDPR [Understanding Data Security]

- Video What Is Email Security? How to Protect Your Sensitive Content With Email Security

- Brief Secure Protocol Package: Strengthening Data Exchange With SFTP and SMTP