Kiteworks: The Modern Solution for Financial Institutions Seeking Compliance With the FTC Safeguards Rule

As a financial institution, it is crucial to ensure that you are in compliance with all relevant regulations, including the Federal Trade Commission (FTC) Safeguards Rule. This rule is part of the Gramm-Leach-Bliley Act (GLBA) and requires financial institutions to implement measures to protect customer information.

What Is the FTC Safeguards Rule and How Does It Apply to Your Organization?

In short, the FTC Safeguards Rule requires financial institutions that offer financial products or services to consumers (such as banks, credit unions, and investment firms) to have a written information security plan in place to protect customer information. This plan must include measures to secure customer data, such as physical security measures to protect against unauthorized access and procedures for detecting and preventing unauthorized access and responding to security incidents.

In addition to having a written information security plan, the Safeguards Rule also requires financial institutions to provide notice to customers about their information-security practices and to train employees on information security. It also requires financial institutions to take steps to ensure that third parties they do business with also have appropriate measures in place to protect customer information.

What Is the Penalty for Violating the Safeguards Rule?

The FTC may impose fines and seek injunctions or other remedies to stop the violation and prevent future violations. The amount of the fine will depend on the severity of the violation and the size of the financial institution. In addition to fines, the FTC may also require the financial institution to implement a compliance program to ensure that it is in compliance with the Safeguards Rule in the future. This could include measures such as regular audits, employee training, and the development of policies and procedures to protect customer information.

It’s important to note that the FTC is not the only regulatory body that can enforce the Safeguards Rule. Other regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB) and state banking regulators, also have the authority to enforce the rule and impose penalties for noncompliance.

So how do regulatory bodies assess and audit adherence to these standards? There are a few ways they may go about this:

- Self-assessment: Financial institutions may be required to conduct self-assessments to ensure that they are in compliance with the Safeguards Rule. This could include reviewing policies and procedures, conducting risk assessments, and testing security controls.

- Examinations: Regulatory bodies may conduct on-site examinations of financial institutions to assess compliance with the Safeguards Rule. These examinations may include reviewing documents, observing practices, and testing controls.

- Audits: Financial institutions may also be required to undergo independent audits to assess compliance with the Safeguards Rule. These audits may be conducted by third-party firms or by regulatory bodies themselves.

Private Content Network for Protecting Sensitive Customer Information

To avoid being found in violation of the Safeguards Rule, it is important for financial institutions to take it seriously and to implement appropriate measures to protect customer information. This may include conducting regular risk assessments, implementing security controls, and training employees on information security best practices. By doing so, financial institutions can help prevent violations of the Safeguards Rule and protect their customers’ personal and financial information.

A modernized approach to file and email data protection with a Private Content Network plays a critical role in helping financial services companies protect their customer information and comply with regulations like the Safeguards Rule.

Sensitive customer data within a customer’s Kiteworks-enabled Private Content Network can help financial institutions comply with this rule by implementing and periodically reviewing access controls, including technical and physical controls, to authenticate and permit access only to authorized users and limit their access only to the customer information they need to perform their duties and functions.

Get MFT Governance, Compliance, and Security With Kiteworks

Kiteworks offers a range of features to help financial institutions protect and manage their customers’ content and communication. Our granular access controls and email policies give financial institutions the flexibility to control who can do what within their organization. For example, financial institutions can set different levels of access to their folders and SFTP policies, including the ability to manage, collaborate, or read-only. They can also add a watermark to viewable content to prevent unauthorized use. These different levels of access give financial institutions the flexibility to control who can do what within their organization.

In addition to granular content access controls, Kiteworks’ email policies include features such as non-forwarding, auto-encrypt, and DRM to help protect the privacy and integrity of their communication. Our email policies also support Microsoft MIP, which allows financial institutions to classify and protect their emails based on their sensitivity level. Overall, these features give financial institutions greater control and security for their content and communication.

The platform also offers a role-based permissions system that allows financial institutions to control access to their content and tools based on the role of the user. Financial institutions can enable or disable email and collaboration features for different roles, and enable access to Kiteworks’ web, mobile, and SFTP clients. They can also set account and file/folder expiration dates to ensure that access is only granted for a limited time. Our platform also includes terms of service that outline the acceptable use of Kiteworks’ services. And to help financial institutions gain secure access to their account, we offer a range of authentication methods. Overall, Kiteworks’ role-based permissions system and other features give financial institutions granular control over how their content and tools are accessed and used.

But it’s not just about controlling access to content and tools. A PCN also offers a range of policies to help financial institutions secure and manage access to their account. These policies include block and allow lists to control access based on IP, country, and domain. Our geofencing feature allows financial institutions to restrict or allow access based on the geographic location of the user. We also have policies in place to help secure passwords, including session timeout and login attempts. In addition, Kiteworks’ key rotation feature helps ensure that access keys are regularly updated for added security. These policies give financial institutions the tools to effectively control and secure access to their account.

Kiteworks is also designed to support the separation of admin duties, giving financial institutions the flexibility to customize access and responsibilities based on the needs of their organization. We offer user management and help desk features to help financial institutions manage and support their users. Our app and system configuration tools allow financial institutions to customize the way Kiteworks’ platform is used within their organization. Additionally, our eDiscovery feature allows financial institutions to search and retrieve content, making it easier to comply with legal and regulatory requirements.

In addition to these security and access control features, Kiteworks is also designed to help financial institutions manage their content and communication in a compliant way. Our eDiscovery feature allows financial institutions to search and retrieve content, making it easier to comply with legal and regulatory requirements. We also offer a range of integrations with other compliance tools, such as Microsoft MIP, to help financial institutions classify and protect their emails based on their sensitivity level.

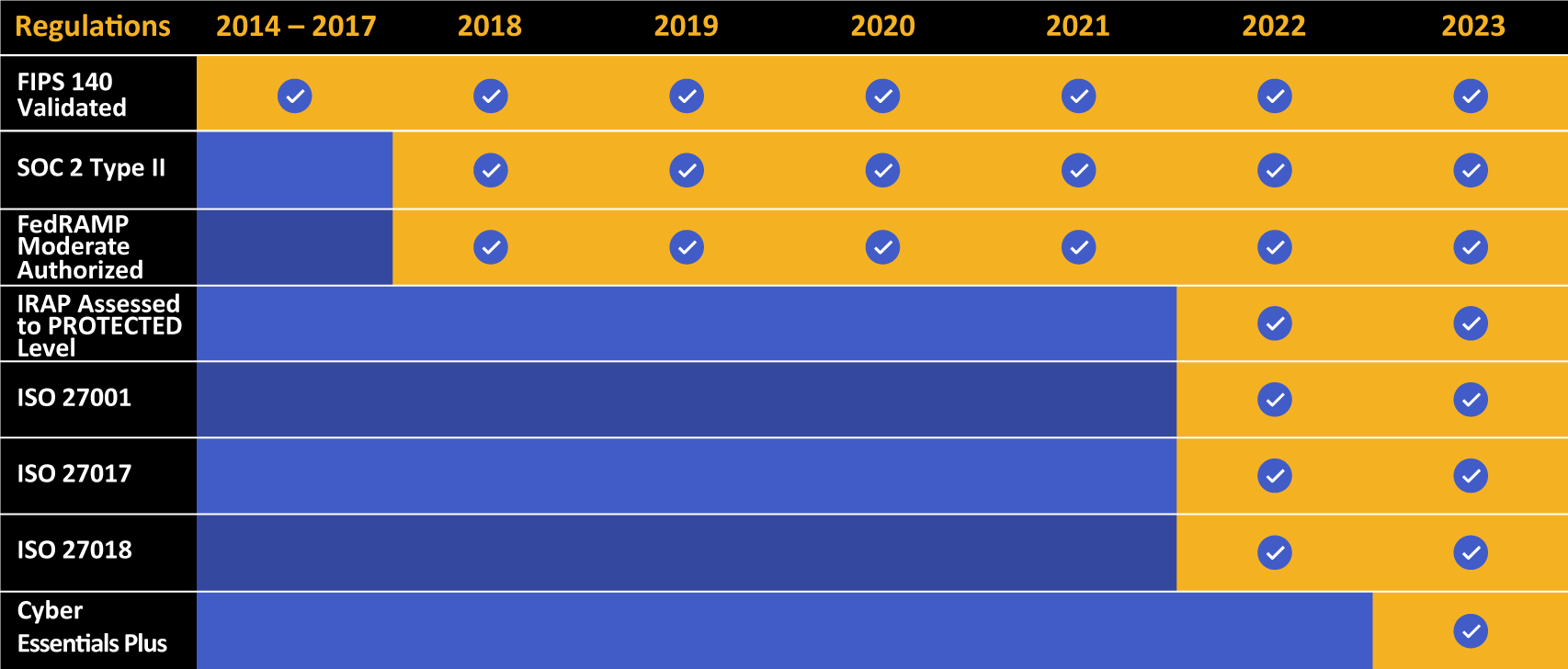

Kiteworks touts a long list of compliance and certification achievements.

Why Is the Kiteworks Platform Best for Financial Institutions?

Overall, Kiteworks is committed to helping financial institutions protect their customer information and meet their compliance requirements. Our platform offers a range of features to help financial institutions control and secure access to their content and communication, as well as manage their content and communication in a compliant way. Schedule a custom demo to see how the Kiteworks platform’s capabilities work in real-world environments.

Additional Resources